How to buy Bitcoins – Bitcoin Buying Guidance

What is Bitcoin?

To eliminate some of the confusion surrounding bitcoin, we need to split it into two elements. On the one hand, it contains a bitcoin-token, a code snippet that represents the ownership of a numerical concept similar to a virtual peer note. On the other hand, it contains the Bitcoin-the-Protocol, a distributed network that holds a book on Bitcoin-token balances. Both are called “bitcoin”. The system allows users to send payments without having to go through a central authority, such as a bank or payment gateway. It is designed and maintained electronically. Bitcoin, such as dollars or euros, is not printed and is produced by computers worldwide using free software. This is the first example of what we now call cryptocurrency, an asset class that shares some of the characteristics of traditional currencies with cryptocurrency validation.

Who created it?

One software developer, Alias Satoshi Nakamoto, suggested using Bitcoin in 2008 as an electronic payment system based on mathematical tests. The idea was to produce an intermediary for exchange, regardless of any central authority, that could be transmitted electronically in a safe, verifiable and immutable manner.

To this day, no one knows who Satoshi Nakamoto really is.

In what ways is it different from traditional currencies?

Bitcoin can be used to pay for things electronically if both parties are willing. In this sense, it is similar to the traditional dollar, euro or yen which is also traded digitally.

But it differs from paper cryptocurrencies in several important ways:

1. Decentralization

The most important feature of Bitcoin is that it is decentralized. There is no individual organization that controls the Bitcoin network. It is managed by a group of volunteer programmers and managed by an open network of dedicated computers scattered around the world. This attracts individuals and groups who feel uncomfortable with the control that banks or government institutions have over their money.

Bitcoin solves the “double spending problem” of electronic currencies (which can easily copy and reuse digital assets) through an innovative set of encryption and economic incentives. In electronic banknotes, banks perform this function, which gives them control over the traditional system. With bitcoin, the integrity of transactions is maintained through a distributed and open network, not owned by anyone.

2. Limited supply

Fiat currencies (in dollars, euros, yen, etc.) offer an unlimited offer: central banks can issue as many as they want and can try to manipulate the value of one currency relative to other currencies. Currency holders (especially citizens with few alternatives) bear the cost.

With bitcoin, on the other hand, the width is strictly controlled by the basic algorithm. A small number of new bitcoins are filtered every hour and will continue to do so at a descending rate until a maximum of 21 million is reached. This makes Bitcoin coins more attractive as an asset: theoretically if demand increases and supply remains the same, the value will increase.

3. Pseudonymity

While traditional e-payment senders are generally identified (for purposes of verification and compliance with anti-money laundering and other laws), Bitcoin users theoretically work in anonymity. Because there is no centralized Verifier, users do not need to identify themselves when they send Bitcoins to another user. When sending a transaction request, the protocol checks all previous transactions to ensure that the sender has the necessary bitcoin currency and the authority to send it. The system does not need to know your identity.

In practice, each user is determined by the address of his wallet. With some effort, transactions can be tracked this way. In addition, police have developed methods to identify users if necessary.

In addition, most stock exchanges are required by law to conduct their customer identity checks before they are allowed to buy or sell Bitcoin currencies, which facilitates another way to track the use of Bitcoin currencies. Because the network is transparent, the progress of a particular transaction is visible to everyone.

This makes Bitcoin not the perfect currency for criminals, terrorists or money launderers.

4. Immutability

Bitcoin transactions cannot be reversed, unlike electronic credit transactions.

This is because there is no central “arbitrator” who can say, “Well, give back the money.” If a transaction is recorded on the network, and if more than one hour has passed, it is impossible to modify.

While this may annoy some, it means that you cannot change any transaction in the Bitcoin network.

5. Divisibility

The smallest unit of Bitcoin is called Satoshi. It is a hundred million Bitcoin (0.00000001) – at current prices, about a hundred of a penny. This can allow for exact transactions that traditional electronic money cannot afford.

How to Buy Bitcoins Online? (Shop Bitcoins)

There are a few steps you should follow to make your first purchase, but if you’re ready and willing to follow it, we’ll let you know how to buy Bitcoins in no time.

Quick tips

Although each step takes some consideration, these are the key points to consider when it comes to making your first Bitcoin purchase:

- Install Bitcoin Wallet offline and set a secure password to protect it.

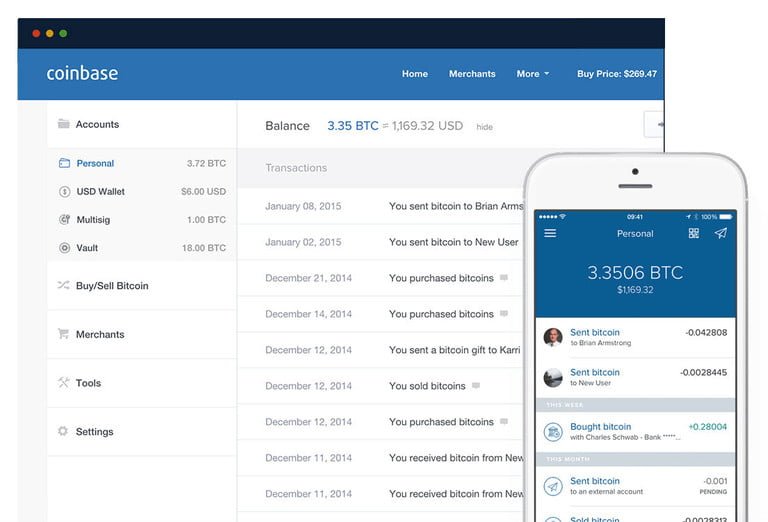

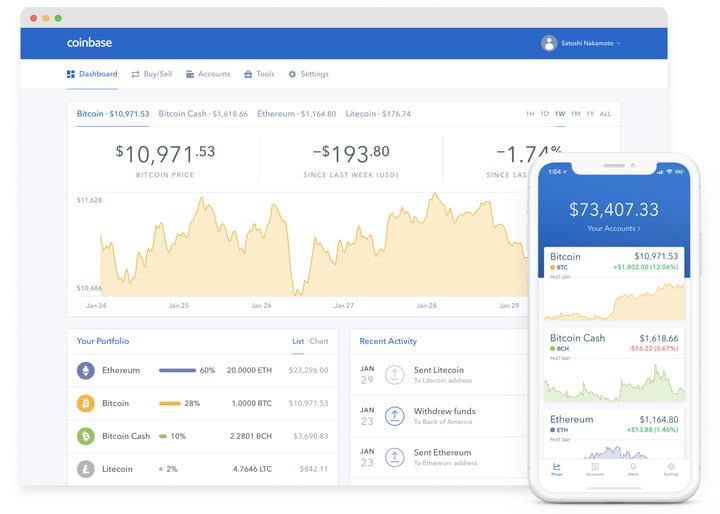

- Set up a Coinbase account (and trading platform, Coinbase Pro, if you want additional control).

- Choose your preferred payment method.

- Buy some Bitcoin!

And another thing is if you are going to buy a bitcoin or whatever online, we are recommended to read this: Important Guidelines to Online Shoppers

Step 1: Find a good Bitcoin wallet

Digital “wallets” are used to store Bitcoin so you’re ready to spend it or replace it with another currency. Portfolios differ in terms of features and platforms that can be used and security on them, so it is important to choose the one that suits you.

To get started, your best option is to use the wallet that is automatically provided to you in the recommended exchange, Coinbase. However, it’s also a good idea to create a non-exchange portfolio in this way, because if the stock market falls or is filled with traffic, you can still access your Bitcoin.

Here are the recommended options:

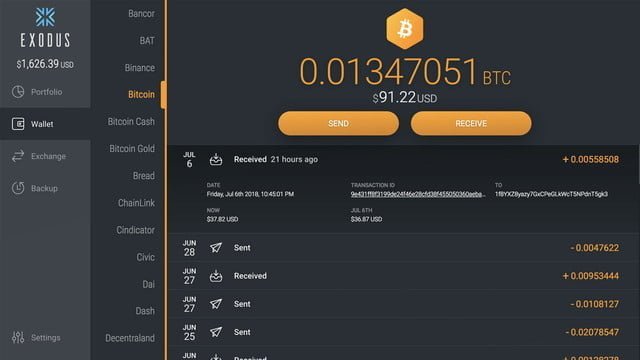

Exodus – an all-in-one offline application with support for a number of cryptocurrencies, including Bitcoin, and Exodus is free to use, and has a built-in currency exchange and some simple graphical tools to help you visualize your cryptocurrency wallet.

Mycelium is a popular mobile wallet known to be compatible with the most advanced technology, such as Trezor (for maximum security) and Tor wallets for devices.

Note: Although an online wallet is good when you buy your first Bitcoin, if you experience a large amount of valuable cryptocurrencies due to trading or an increase in value, be sure to store it in an offline “cold storage” wallet. For maximum protection

Step 2: Choose the right Bitcoin trader

The best place to make your first Bitcoin purchase is to exchange. There are a lot of exchanges there, with different performances. Some are less trustworthy than others, and some may be very limited, so it’s important to choose the right exchange to start with. We recommend using Coinbase, although there is no harm in checking the competition using the Bitcoin exchange comparison site.

Signing up for a Coinbase account is easy, although you’ll need to provide some form of identification. This may include sending a copy of your photo ID as well as sending a photo directly to your face using a webcam. It is important to follow these rules because they allow the site (s) to comply with the KYC regulations.

Although Coinbase alone will allow you to buy and sell Bitcoin, it is also worth enrolling in its associated exchange platform, Coinbase Pro, which will give you greater control over your purchases.

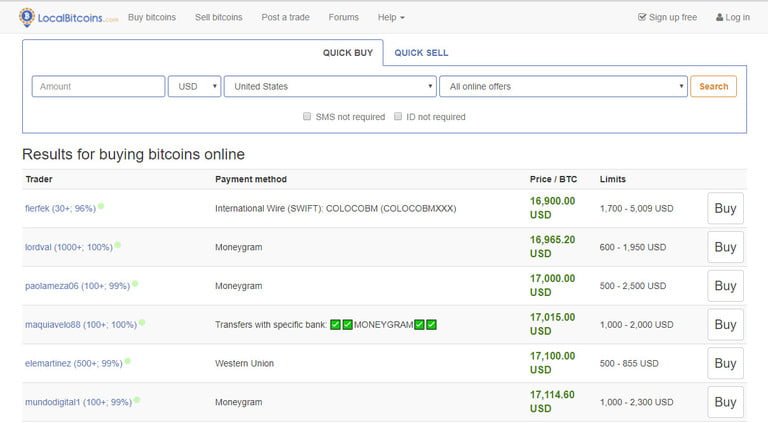

If you prefer to take a more direct route in purchasing Bitcoin, you can choose to use a peer-to-peer service such as LocalBitcoin or BitQuick. They offer a wide range of payment options and let you buy Bitcoin directly from the seller without an exchange broker. If you choose to use it and plan for personal trading, make sure you meet in a safe place.

Step 3: Select your payment method

Stock exchanges accept a variety of payment options depending on what you want to use. This is a problematic point for many exchanges, as some payment methods have been used to scam vendors for quick money in the past. Coinbase allows bank transfers and credit or debit cards for payments and the payment solution must be linked to your account before you can exchange. Paypal is not compatible with Coinbase and for good reasons.

Note: Bitcoin ATMs allow you to exchange Bitcoin in compatible cash wallets. These ATMs are available in a limited number of cities but offer an alternative to withdrawing funds using the stock exchange. Again, most stock exchanges and online portfolios will not deal directly with cash.

Step 4: Buy some Bitcoin and store them in your wallet

Stock exchanges provide you with information about the number (or amount) of Bitcoin currency that you can buy for specific amounts of money. However, due to its volatile nature, Bitcoin prices can vary significantly by exchange and from moment to moment. This means that even if you have a lot of money to spend, you are likely to buy a fraction of Bitcoin. There is nothing wrong with that, and for most people, this is the path they will follow with little, but the wealthy can pay more.

To make your first exchange, enter the amount of Bitcoin you wish to purchase in the field provided and click the “Buy” button. In Coinbase or Coinbase Pro, this will be a basic “order to buy” order, which will buy Bitcoin at the best market price. Alternatively, you can place a Limit order, which allows you to set a price you would like to pay for a certain amount and the transaction will not be executed unless that amount appears at that price.

Once your purchase is completed, the new Bitcoin will be stored in your Coinbase wallet. Next, you should look for the option to transfer these funds to the address of the Bitcoin wallet you created and that is out of stock. You will have to pay a small fee to do so, but this is an integral part of Bitcoin conversions. Fortunately, the prices of these deals are far from peak.

Important note: Bitcoin transfers can be a bit intermittent. Unlike other currencies, when you buy Bitcoin funds. The transaction must be recorded in the blockchain and confirmed. This can take some time, especially during busy working hours. It’s not uncommon for the process to take an hour or two, so you may not want to jump right into your account and start moving money.

Step 5: Get ready to use Bitcoin

Whether you’re planning to eventually sell your bitcoin (hopefully making a profit) or use it to buy something, be prepared to do so at any time. The way that the value of Bitcoin fluctuates is important so you have planned your final game from the beginning. Get ready by setting up a merchant account now, or learn how to buy what you want to use before you really plan to do so. That way, when the time comes, you won’t be in a hurry as everyone tries to do the same.

To find out where you can spend Bitcoin, here’s a list of compatible online stores. Always read reviews and print accurately before making any purchase or replacement with Bitcoin.

How to Sell Bitcoin (Shop Bitcoins)

Have you decided it’s time to get out of Bitcoin fashion, or do you simply want to be prepared when you do? In this guide, we will teach you how to sell Bitcoins to make sure that you can withdraw anytime and get what you owe in return. However, keep in mind that if you decide to sell at the same time as anyone else, you may experience problems. Luckily, we’re here to talk about them all, so you can be sure you’re selling your encryption the right way. For those of you who don’t have the first piece of your bitcoin cake yet, be sure to read our guide about everything about bitcoin and how to buy first.

Step 1: Setup an exchange account (Selling Bitcoin Correctly)

The simplest and “automated” way to convert your bitcoin into cash is through an exchange platform. They act as intermediaries for famous decentralized cryptocurrencies by selling your bitcoin. Since it is one of the most famous and famous rules, we recommend using Coinbase. If you prefer to choose for you, there are many others to choose from.

It’s easy to apply for an account, but there are a few steps you should follow. Depending on the country you are in, you must adhere to the various forms of “Know Your Customer” rules, which may mean sending certain forms of identification to the site. It may take a few days to process. It is also recommended to sign up for Coinbase Pro at the same time, although it is not very necessary, to give you more control over your sale.

Once you’ve created your account, link your bank account so that, when you perform the transaction, you can withdraw your money with minimal inconvenience.

Step 2: Transfer your Bitcoin to your exchange wallet (Selling Bitcoin Correctly)

If you follow our guide on how to buy Bitcoin, Bitcoin will be stored in a safe, and possibly cool, portfolio. To trade in Coinbase, you must send Bitcoin to your exchange wallet.

Use the transfer function in your own wallet to send and wait for multiple confirmations as they arrive. This may take a few hours, or if it is a particularly busy time, two days.

Step 3: Place a sell order (Selling Bitcoin Correctly)

With the setup of your swap account, your linked bank account and Bitcoin deposited on the exchange, it’s time to make a sale. To do this, log into your Coinbase or Coinbase Pro account and go to the trading part of the exchange. Make sure you choose to sell, rather than buy Bitcoin, and enter the amount you want to redeem. From there, you can place a “sales order” for sale at the current market price, or alternatively, place a “limit” order, which will be sold only when the price is the way you are satisfied.

From there, the exchange will be done without any input from you as long as the sale is done at a reasonable price, such as the market price, the trade should occur relatively quickly. Once you do this, your Bitcoin currency will be transferred from your account and your account will be charged in local currency in the selected paper currency.

Step 4: Transfer your funds to your bank account

Once you have completed the exchange, it is time to take your money out of the exchange. Select “Withdraw” from the menu and choose “Bank Transfer” in the “To” field. Then enter the amount you’d like to send to your bank account. When you’re ready, verify that you’ve entered all the correct information and that your bank account is properly linked to your swap account. Then select “Withdraw” to complete the transaction.

While there may be a slight delay in your submission, the funds should reach you relatively quickly. and that is! I have sold your Bitcoin successfully.

Alternative methods

If you prefer to participate more in the actual sale, direct exchanges (or peer exchanges) are a possible alternative. You must register, which in some cases means confirming your identity, so, as with all sales methods, we recommend that you set up your account long before you really want to sell. However, once configured, you can sell your Bitcoin coins in a much more “direct” way.

Unlike exchanges, where transactions are done automatically, you must make the transaction in direct contact with the buyer. Set up a sales order with a specific value and when someone comes up with the agreed price, the site will alert you that you can follow the deal. Once approved, the buyer pays you, and then sends you the cryptocurrency in return.

The actual method of making a payment depends to a large extent on the platform through which the exchange takes place. Sites like BitQuick keep things online exclusively, using bank account transfers. However, sites like LocalBitcoin or Paxful have many options, including Moneygram, gift cards, cash by mail and even personal cash.

Although some of these methods are time-consuming, many are anonymous and can allow you to keep your treatment out of prying eyes if this is an advantage for you. If you decide to make a personal exchange, be sure to do so in a public environment.

How to Make Bitcoin (Best Methods)

If you want to know how to extract Bitcoin, you have two different steps that you can follow: go through a company or buy and use your own hardware. Let’s look at both options and why going through a company is currently the best way to extract Bitcoins for profit.

Remember, research is important! Like when it comes to buying Bitcoin or altcoins, you should keep in mind that nothing in the world of cryptocurrencies is guaranteed. Any investment could be lost, so be sure to read before taking out your credit card and having a secure Bitcoin wallet waiting.

Mining vs. investment

When Bitcoin was first introduced in 2009, the world’s first and major cryptocurrency mining needed a little more than a home computer, not even a fast one. Today, the entry barrier is much higher if you want to get some benefit from doing so. This does not mean that this is impossible, but it is not the home brewery that was once.

Before discussing how to extract Bitcoins yourself, it is important to keep in mind that despite the uncertainty in everything related to cryptocurrencies, mining is probably the most volatile. Fluctuations in hardware prices, changes in the difficulty of Bitcoin mining and even the lack of a guarantee of payment at the end of all of its hard work make it a more risky investment than buying Bitcoins directly.

Because of this and the overall volatility of the market, it may be difficult to know how much profit you will get from mining. In 2018, the mining market collapsed in terms of profits and rose dramatically when it came to entry barriers. Unless there is a significant change in Bitcoin technology, it is likely to remain the same. One bitcoin is valued at about $ 3,800, but a recent report indicates that the cost of extracting it amounts to $ 2,400. However, this report is disputed by some miners.

In the end, buying at least Bitcoin directly gives you something for your money right away. Definitely worth considering before following the mining route.

Step 1: Pick your mining company

Cloud mining is a practice of renting mining devices (or part of your retail power) and having someone else mining on your behalf. You are usually paid for your investment with Bitcoin. Even if the devices are not used to extract Bitcoin. As with public investment, it is important to investigate, because there are many companies that claim to be the best and even the biggest have their critics.

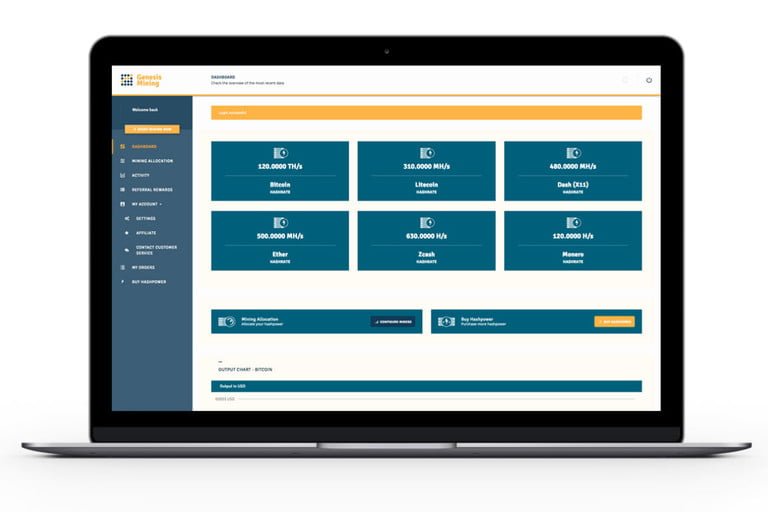

Genesis Mining is perhaps the largest and most famous in the group. He told HashFlare Digital Trends in an interview that each of his clients made a profit using his service. However, he said that if many of them had invested in Bitcoin in time, they would have earned more money.

For a wide range of options, CryptoCompare maintains a list of mining companies with user reviews and ratings, although there are many reviewers looking to show their reference codes in the comments section.

Step 2: Choose a mining package

Once you have selected and registered the cloud mining provider, you must choose the mining package. This usually involves choosing a certain amount of hashes and cross-references with the amount you can pay. Paying more often gives you a better return or you’ll get a quicker profit, but that’s not always the case.

Most cloud mining companies will help you make a decision by giving you an account based on the current market value of Bitcoin, the difficulty of extracting Bitcoin and cross-references with the retail power you rent. However, it’s important to keep in mind that these numbers can change and occur, so it’s important to monitor market trends and estimate the direction of Bitcoin’s action before choosing your contract. What may be profitable now may not be if the Bitcoin value fails.

Some cloud mining companies will sell you a “pre-sale” contract. You are already asked to pay in advance for a contract that will not begin for weeks or months when new devices are available. In most cases, this is not recommended because there is no way to ensure that these contracts are profitable at their inception and not even a tangible sign of this happening.

Step 3: Pick a mining pool

After choosing your contract, most cloud mining companies will ask you to pick a mining pool. That’s where you choose a global mining team to join.

It is a method to increase the chances of winning Bitcoin through mining and is a standard practice in the cloud and personal mining. There are advantages and disadvantages of the different groups that go beyond the scope of this article, but joining an established and tested group with low rates is likely to be your best option.

One of the most popular and reliable pools for new miners is Slush Pool, but you should always do your own research. Like companies, many groups are not reliable.

Step 4: Select a wallet

Once you have completed that step, your cloud mining can begin and within a few days or weeks, you should start to see that your cloud mining account begins to fill up with Bitcoin. Withdrawing it and putting it in a secure wallet is a good plan as soon as you have a small farm, although some miners in the cloud will allow you to reinvest your earnings to get more hashing power.

Of course, then you must decide what you are going to do with your long-term bitcoins. While there are many products and services that you can buy with bitcoins, prices may fluctuate and you may have to investigate further to see if you are getting a good deal.

What if I want to mine with my own hardware?

Due to the high costs involved, it is recommended to extract Bitcoin only if you have easy access to abundant electricity and most importantly, is a strong and strong network connection. Before investing in hardware or mining configurations, it’s important to use a Bitcoin mining calculator to see if you can really make a profit taking into account all costs.

If you can, you should choose the appropriate ASIC mining agent to do so. The best way is to check the profitability of the mining machine to see the miners who are currently making profits. Asicminervalue.com is particularly useful here, showing a constantly updated list of miners and their profitability. Keep in mind that the most profitable devices earn between $ 10 and $ 30 a day.

Today, we are discussing How to buy Bitcoins, and sell, and mining techniques. and we think you are getting an idea about the bitcoin process.

Author: J.N.Rupasinghe

Further More Related Articles :

- Shopping guide around the world City

- How to Identified best product before online shopping

- Online Coupon Code

- Everything is the online shopping

What do you think about this How to buy Bitcoins – Bitcoin Buying Guidance Article comment below and Read More Articles Click Here